Cornerstone Therapeutics (NASDAQ:CRTX) recently caught our attention following the announcement of an FDA Cardiovascular and Renal Drugs Advisory Committee (CRDAC) to review their NDA for lixivaptan (CRTX 080) for the proposed indication of the treatment of symptomatic hypervolemic and euvolemic hyponatremia associated with heart failure and syndrome of inappropriate antidiuretic hormone (SIADH), respectively. The meeting is scheduled for September 13, 2012. There are some troubling red flags we want to point out.

Background

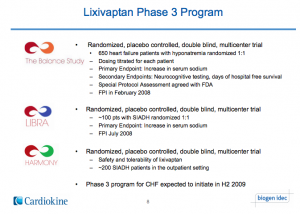

The history of Lixivaptan starts way back with a privately held specialty pharmaceutical company, Cardiokine. Their lead compound lixivaptan was licensed from Wyeth in 2004. Eventually, Cardiokine landed a nice partnership with Biogen in 2007, who largely funded the Phase 3 development of the drug. Specifically, they launched the BALANCE, LIBRA and HARMONY study. Everything was going great for Cardiokine. See the image below of the Phase 3 program. (We certainly have a lot more to say about this.)

Biogen eventually realigned their entire R&D in late 2010, wherein they dropped the Lixivaptan partnership prior to the completion of the Phase 3 program. As their CEO Amber Salzman said shortly afterwards,“They were a great partner, and the termination was a great outcome for us. If the Phase III study results show lixivaptan to be effective, Cardiokine should be able to sign up another Big Pharma partner to help commercialize the drug. Currently, the company is on track to file a new drug application with the Food and Drug Administration in mid-2011.”

Unfortunately, not all fairy tale drugs and CEO speak end so nicely. Fast forward through the apocalyptic aftermath of Cardiokine-Biogen breakup and we eventually hear Lixivaptan achieved positive phase 3 clinical trial results in November 2011 leading to a New Drug Application (NDA) submission filed just prior to the close of 2011.(This timeline doesn’t really feel right and we will point out why later.)

Before the end of 2011, Cornerstone picks up Cardiokine for $1 million at closing and is assuming $2 million in Cardiokine’s debt. Cornerstone will owe another $8.5 million if the Lixivaptan NDA is approved by the FDA with some other royalty and sales milestones built-in. Lixivaptan now has an FDA AdComm scheduled for September 13th and a PDUFA date of October 29, 2012.

Current Market

Lixivaptan is a part of the vaptan family of drugs. Vaptans act by inhibiting the action of vasopressin on its receptors (V1A, V1B and V2). Vasopressin antagonists are involved in the process of excretion of electrolyte-free water—known as aquaresis. There are currently 2 approved vaptans for hyponatremia: Samsca(tolvaptan) sold by Otsuka Pharmaceutical and Vaprisol(conivaptan) by Astellas. Sales of vaptans have been less than stellar; sales of Samsca were only $84M last year and Vaprisol sales aren’t even reported. See their labels for more info(Samsca, Vaprisol).

Samsca was approved in 2009, but had an advisory panel in 200. The briefing materials can be found here, under “June 25,2008”). Samsca’s indicated use is “for the treatment of clinically significant hypervolemic and euvolemic hyponatremia [serum sodium <125 mEq/L or less marked hyponatremia that is symptomatic and has resisted correction with fluid restriction], including patients with heart failure, cirrhosis, and Syndrome of Inappropriate Antidiuretic Hormone (SIADH) (1)." Tolvaptan and lixivaptan have high specificity for the V2 receptor (tolvaptan has a 30-fold affinity and lixivaptan a 100-fold affinity for V2 compared with V1a), whereas conivaptan is known as a combined V1a/V2 receptor antagonist (10-fold greater affinity for the V1a receptor). Managing hyponatraemia relies primarily on the use of intravenous sodium-containing fluids (normal saline or hypertonic saline) and fluid restriction. According to IMS Health, the intravenous sodium-containing fluids market was valued at approx US$367 million in 2008. Immediate Red Flags

There are several notable red flags that makes us cautious about investing in Cornerstone for the promise of Lixivaptan.

(1) First, all 3 phase 3 trials are missing peer-reviewed publications and medical conference presentations long after completing their clinical trials. We have only been able to come across a poster presentation of the small Phase 3 HARMONY study that was presented at the 2011 Kidney Week proceedings. This was a small study in the outpatient setting for patients with euvolemic hyponatremia.

I spoke with an investor relations rep at Cornerstone who said they expect publication of the results sometime in November. He wasn’t aware of an SPA that Biogen claims the study had. Investors in Cornerstone are essentially going to be left in the dark because management does not feel the need to share this data before the Advisory Committee.

When they first announced the acquisition of Cardiokine, their PR stated that ,”New Drug Application for lixivaptan filed Dec. 29, 2011; FDA approval expected in Q1 2013; Expected launch of the product in the U.S. hospital market in 2013.” We note that this was before the PDUFA date was known, however, this is still an oddity given the known PDUFA review timelines.

(2) We are not optimistic that their Phase 3 program is really large enough to establish a therapeutic benefit. For example, Otsuka ran a 4,000 patient study(EVEREST) showing no real improvement in morbidity or mortality but improvements in sodium levels in adults with worsening congestive heart failure (CHF). Yet somehow Cornerstone/Cardiokine thinks they will with a 650-patient study? We find this hard to believe. Currently, no vaptans have shown improvements in long-term clinical trials, pharmacoeconomics or mortality for patients with heart failure.

(3) While Cardiokine was in somewhat dire straits to sell the company in 2011, if they actually had positive data for the outpatient CHF indication, we believe they could have signed a highly favorable deal relative to what they got from Cornerstone. Biotech companies have a propensity to announce positive data when they have it, not wait and hold to announce them years later. I emailed Dr. William Abraham, the lead PI on the study, and he wouldn’t comment on the results nor my questioning of whether he would actually use it for the indication.

(4) The timeline here doesn’t make much sense for their Phase 3 BALANCE study and NDA submission. We’ve seen reports that it reached the primary endpoint in November 2011 and they submitted an NDA on December 29th, 2011. The BALANCE study (NCT00578695) shows it completed in June 2010 and was last updated on June 2011; the primary endpoint was 60 day blood serum sodium levels. However, there was not an announcement about positive data until November 2011. Additionally, submitting an NDA in under 2 months seems quite hasty for a company that was near bankruptcy and of limited resources. Something just doesn’t add up here.

(5) Cornerstone makes some wildly bullish market claims. “Hyponatremia affects up to six million people in the U.S. with direct medical costs estimated to range between $1.6 and $3.6 billion annually.” We would love to see the assumptions and methodology for producing such outrageous estimates, namely, how Lixivaptan will help cure these ills, especially in light of how poorly other currently marketed vaptans have done.

MedScape says it best, “Vaptans are most valuable for the treatment of hypervolemic hyponatremia, as the individual variability in therapeutic effect is of less immediate concern, and correction of the hyponatremia may have additional benefits for long-term survival. Vaptans are also useful in patients with subacute or chronic forms of SIADH, including patients with psychogenic polydipsia. However, the role of vaptans in treating acute, symptomatic or severe forms of hyponatremia in SIADH is less certain because intravenous infusion of hypertonic (3%) saline is just as safe and cheaper, and the effects are more predictable and easier to control.”

Some other useful references: “Vaptans are not the mainstay of treatment in hyponatremia: perhaps not yet”(link) and “Fresh from the Pipeline: Tolvaptan”(link)

Conclusion

Cornerstone largely relies on sales of net sales from CUROSURF and the ZYFLO, however, the recent approval of SURFAXIN might start to put a ding in those sales of CUROSURF, a porcine surfactant. They also recently completed their acquisition of EKR Therapeutics which should help bolster sales numbers to some degree.

Cornerstone’s shrouding of the Phase 3 data surrounding Lixivaptan is very troublesome. The company might argue that it is not a material disclosure, since the program was acquired from Cardiokine. But now that Cardiokine is a subsidiary of Cornerstone, the company should know better. We look forward to the briefing documents on this one.

Disclosure: No position currently.