We believe this is an opportune time to revisit BELLUS Health (BLU, BLU.TO), as their Phase 2b trial results are set to be released in Q3 (interim analysis) and Q4 (Top-Line results) this year. Recall, this is a clinical stage biopharma company based in Canada (Laval) and the US (Philadelphia), developing novel medicines for the treatment of chronic cough and hypersensitivity disorders. Their focus is developing their novel drug BLU-5937, a P2X3 inhibitor to treat refractory chronic cough (RCC), a very large market opportunity without any proven treatments currently available.

After a setback in the clinic in 2020 that devastated the stock price, the company made important adjustments to its clinical trial strategy to position the program with a higher probability of success. Despite that previous setback, we see reason for optimism not only from a pre-specified subgroup analysis within that study itself but also from corroborating external evidence for the P2X3 drug class. We believe the company’s rationale for the design of its Phase 2b trial is sound and, due to an enriched patient population, has a higher probability to produce positive results, unlike the previous study. The catalyst for BLU shares can potentially begin in Q3 with a positive interim analysis and will be fully realized in Q4 with the complete trial readout that should catapult this company back into the spotlight of the chronic cough field and bring the stock price back to the highs of 2020.

BLU-5937 Mechanism of Action – P2X3 Antagonism

P2X3 receptors are ATP-gated ion channels on the cell surface of nociceptor sensory neurons. The nociceptor sensory neurons densely innervate peripheral tissues, and they mediate certain pain, inflammatory and reflex responses. P2X3 receptors are a driving force behind chronic cough, particularly as the sensory neurons where these receptors are active are found to line the respiratory tract, and they are activated by extracellular ATP, which is released by cells in response to inflammation or injury. ATP exposure stimulates the P2X3 receptors to enhance the cough reflex. A chronic inflammatory state in the respiratory tract will continually trigger P2X3, which ultimately causes the neurons to release their neurotransmitters and induce the involuntary cough-inducing sensation. Chronic cough reflects a natural cough-induction system gone out of balance and that is too sensitive to external stimuli.

P2X3 is the most promising target for chronic cough with multiple clinical trial supporting this approach. Merck’s drug, gefapixant, is the most advanced P2X3 antagonist in development, and it has now scored multiple trial successes. In a Phase 2 study, it showed 37% reduction in cough frequency compared to placebo at its highest dose tested (50mg BID). This effect moderated in two larger Phase 3 trials comprising over 2000 patients, where it showed 16% and 18% efficacy, respectively, with a 45 mg BID dose. However, in all trials, Merck’s drug showed dramatic levels of taste-related AE’s. At their efficacious 45mg BID dose, 58% and 69% of treated patients in the two Phase 3 trials experienced taste-related AEs. These AEs are likely caused by the drug’s weak selectivity for P2X3 and its off-target antagonistic activity against similar (but different) P2X2/3 receptors that are involved in taste perception, as we will discuss below. High selectivity and very low frequency of taste AEs will prove to be a differentiator for BLU-5937 when it enters the market in the future.

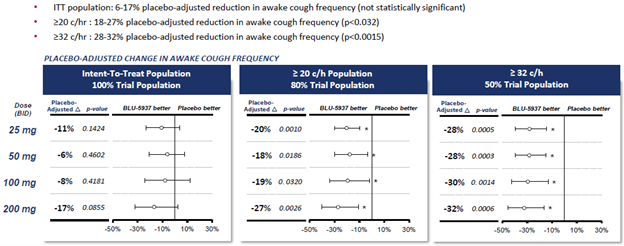

Another P2X3 antagonist drug being developed by Shionogi, called sivopixant, provides further proof of concept for the class with its 32% reduction of cough frequency vs. placebo in a small Phase 2 trial (with high baseline cough frequency). And lastly, BLU-5937 indicated a sizable efficacy range (between 17-32% at the best dose) tested in Phase 2 including sub analyses excluding low frequency cough patients, as we will discuss in depth below. P2X3 is now a highly validated target for chronic cough preclinically and in humans.

BLU-5937 – A prior Phase 2 Study with a miss and a Silver Lining

In 2020, BLU-5937 failed to meet the primary endpoint in the placebo-controlled Phase 2 dose-ranging study known as RELIEF. The RELIEF trial did demonstrate a trend of 17% reduction in awake cough frequency at the highest dose in the intent to treat population, but this difference was not statistically significant, and the overall trial therefore failed, resulting in a major setback for the company. But this setback came with a silver lining. In a prespecified analysis excluding those with awake cough frequency of less than 20 coughs/hr at baseline, which would be considered a milder form of the disease, the result was statistically significant for all 4 doses, with an efficacy range of 17% up to 32% at the highest dose (200mg). In a further subset limited to only those with the highest cough frequency, having ≥32 coughs/hr, the efficacy ranged from 28-32% vs. placebo at all doses, which was also statistically significant. The following slide summarizes the results.

The company concluded from this data that a certain threshold of cough frequency is needed for efficacy with this mechanism of action. The next trial will be enriched for only patients who have at least 25 coughs/hr awake cough frequency, and it thus provides a better probability of success. Any time a drug program proceeds based on a subgroup analysis it is important to evaluate the likelihood of this effect being real rather than statistical noise. That this analysis was prespecified and anticipated to some degree adds to our confidence. The fact that the treatment effect becomes even more pronounced compared to placebo as they stratify to the higher level of baseline cough frequency (≥ 32 coughs/hr) gives it stronger credibility.

External support for a cough frequency threshold for benefit with P2X3 drugs

Results from the other agents within this drug class also suggest a cough frequency threshold effect. Based on our research of the available clinical trial evidence within the P2X3 drug class, we believe that BELLUS has uncovered a minimum cough frequency threshold for efficacy as an underlying characteristic of the P2X3 receptor mechanism of action in chronic cough. Several lines of evidence support this thinking and give us confidence in the Phase 2b patient enrichment strategy.

Firstly, when we consider the baseline patient characteristics in the positive trials of gefapixant, it becomes clear that the overall results benefitted from a high average cough frequency of enrolled patients, who experienced 24 and 25-30 coughs/hr at baseline in the two trials. Given that the majority of the patients in the trial would be expected to have higher cough frequency, as occurred in RELIEF, a large n (approximately 700 and 1300, respectively in the two gefapixant Phase 3 trials) would drown out the null result from the subset with low awake cough frequency at baseline. This is illustrated directly in a recent abstract presented by Merck at ATS International Conference in May 2021 showing subset analyses of pooled data from both of gefapixant’s Phase 3 trials.

Source: Merck Presentation at American Cough Conference June 12, 2021

Source: Merck Presentation at American Cough Conference June 12, 2021

As you can see on the highlighted line, for the 45 mg BID dose (red bars), the confidence interval in the < 20 coughs/hr subset overlaps with 0 and therefore indicates no statistically significant benefit was achieved in this population. In contrast, at or above these 20 coughs/hr thresholds the result was statistically significant, and therefore the patient benefit of the overall population was driven by the experience of higher frequency chronic subgroup. This is a strong support to BELLUS’s hypothesis and clinical trial strategy.

We likewise point to Shionogi’s Phase 2 result where 32% benefit vs. placebo was observed for their P2X3 antagonist drug in a small number of patients, in our opinion owing itself to the very high baseline awake cough frequency of 56 coughs/hr. Furthermore, in a peer-reviewed publication analyzing a Phase 2 study of gefapixant, an interaction effect between the baseline daytime cough frequency and response to treatment was found statistically significant with a p-value of p=0.006. From a scientific mechanism perspective, it is quite possible that a tonic low- level background of chronic cough is being driven by other biochemical pathways yet to be uncovered, while P2X3 activity governs a particularly excessive cough frequency on top of this that gets activated by a distinct set of pathological stressors and signals marking the severe condition. We note that almost all of the people who seek treatment for chronic cough fall into this more aggressive subset of disease where the condition impacts daily life more obtrusively and would therefore likely benefit from P2X3 drugs. We believe the BLU-5937 Phase 2b trial will show highly compelling data by excluding the patients of low chronic cough frequency who do not benefit from P2X3 antagonism.

Taste Side Effects – Superior drug Safety Profile with BLU-5937

A consistent theme during the gefapixant development program has been a high frequency of taste-related side effects at the efficacious dose. As an example, 58% and 69% of gefapixant treated patients in each of the two Phase 3 trials run by Merck experienced taste-related side effects, and this was accompanied by high discontinuation rates. This is in stark contrast to BLU-5937 which showed <10% taste-related AEs in the RELIEF trial at all doses. This distinction is likely due to a difference in selectivity for the P2X3 receptor between these agents. While the P2X3 being targeted by these therapies is a homotrimer made up of three P2X3 subunits, there is another closely related ATP-gated ion channel receptor known as P2X2/3, which is a heterotrimer containing one P2X3 subunit. This other P2X2/3 receptor is responsible for conducting the nerve signaling from taste buds to the spinal cord. It works via the production of ATP by tastebuds to trigger the P2X2/3 receptor, causing downstream signaling to the gustatory nerves, thereby modulating, and controlling the sense of taste and the differentiation of varying types of tastes. The selectivity of the P2X3 antagonist drug is critical because any off-target activity at the P2X2/3 receptor will interfere with P2X2/3 signal transduction and result in altered, or loss of, perception of taste. We note that Merck’s gefapixant P2X3:P2X2/3 selectivity is only 3-7x, which helps explain the high frequency of taste-related side effects with that drug. Shionogi’s sivopixant reported lower frequency of side effects with a 250x P2X3:P2X2/3 selectivity profile, and BLU-5937 is the most selective agent currently under development with an even higher 1500x selectivity for P2X3 over P2X2/3. This should lead to the most favorable tolerability profile in the P2X3 drug class.

The specific taste-related side effects experienced in patients on gefapixant were most often dysgeusia – an alteration of taste perception causing every food to seem sweet, sour, bitter, or metallic, hypogeusia – a reduced ability to taste sweet, sour, bitter, or salty substances, and ageusia, which is the complete loss of taste perception. These side effects are all consistent with a non-selective off-target disruption of P2X2/3 signaling by Merck’s drug. These effects are highly undesirable by patients, as evidence by the high rates of discontinuation due to AEs of 15% and 20% in Merck’s two Phase 3 trials. BLU-5937’s high P2X3 selectivity and superior safety profile will provide a more pleasant patient experience and make it the desired agent within the P2X3 drug class for refractory chronic cough.

SOOTHE Phase 2b Trial Results – The Catalyst to Revive the Story and Launch the Stock Price

It is all about the data. All the value in BELLUS Health hinges on its successful development of BLU-5937, and the results of the Phase 2b trial will seal this drug’s fate in the treatment of chronic cough. Recall that this double blinded placebo-controlled trial is conducted exclusively in patients with ≥25 coughs/hr to enrich the trial with a patient population most likely to benefit from P2X3 antagonism. There will also be a separate exploratory cohort to test the effect in patients with 10-25 coughs/hr at baseline, but we expect this is less relevant and less likely to show an effect. BELLUS is testing 12.5 mg BID, 50 mg BID, and 200mg BID doses in 300 patients, and the study began in Q4 2020. For the interim analysis that is scheduled to take place in Q3, an independent statistician will be evaluating the trial based on follow-up of the first 50% of patients enrolled and followed until their primary endpoint analysis, to determine whether one or more of the doses has a high statistical probability of producing positive results at the full trial analysis (which will be subsequently in Q4). This is based on prespecified efficacy and probability measures which require a significant difference from placebo in awake cough frequency benefit. Should a positive signal be communicated to BELLUS, this would enable them to aggressively invest in the Phase 3 program “at-risk,” while the Phase 2b trial continues, to speed the development path.

Due to BELLUS Health’s patient enrichment strategy based on a baseline awake cough frequency threshold, we believe that hitting this efficacy mark in the interim analysis at only half of the anticipated sample size is a distinct possibility. While a positive signal in Q3 wouldn’t guarantee a positive trial outcome for the full study, BELLUS set a relatively high bar for this analysis, and it would increase our confidence in the probability of a successful outcome in Q4. It is important to note that if no positive signal is reached at the interim analysis, this will not mean that the trial cannot still be positive in the full analysis set. It may simply mean it is underpowered at half enrollment to have high statistical certainty about any of the doses, and BELLUS will need to await the final study results before proceeding to a Phase 3 program. The takeaway here is that the interim analysis in Q3 is not a “make or break” type of catalyst, but in the event that it turns out positive, it can give us some additional reassurance about the top-line readout in Q4.

In March 2021, the anticipated enrollment was increased to 300 patients from 280, helping to optimize the trial design. The adaptive trial design was a wise decision by BELLUS that can only help produce a favorable outcome by ensuring that if the drug truly has efficacy, this will be more likely to be detected as a statistically significant difference from placebo. We are confident in the optimized SOOTHE trial design, and we anticipate the outcome of the trial in Q4 to reflect a ~25% placebo-adjusted reduction in awake cough frequency at one or more doses with very low incidence of taste-related side effects.

Other Upcoming Catalysts

In addition to the interim analysis and final results of SOOTHE Phase 2b trial within the next 5 months, investors should be on the lookout for additional catalysts that can impact trading in BLU.

On August 3rd Bayer released the news regarding their Ph2b clinical trial in RCC (Link), stating:

“Positive results from the Phase IIb clinical trial evaluating the efficacy and safety of its investigational orally administered, potent and selective P2X3 receptor antagonist eliapixant (BAY1817080) in patients with refractory chronic cough. The primary efficacy outcome was met showing a statistically significant improvement in 24-hour cough counts per hour (average hourly cough frequency based on 24-hour sound recordings) over placebo after 12 weeks of treatment. The data showed a favorable safety and tolerability profile.”

We believe Bayer Ph2b results are another validation for the P2X3 class, and bodes well for BLU-5937

Shionogi has been running a Phase 2b trial of its own P2X3 antagonist, sivopixant, but has yet to reveal the results. We expected that the result could be announced at their quarterly earnings call, or perhaps presented at the European Respiratory Society conference in early September, but for now they didn’t release the RCC data at the earnings report and in the presentation, a slide mentioned “details regarding 8 core projects to be reported at R&D Day on September 28t”. The competitive profile of the drug will become clearer from this data release, and the P2X3 drug class can be potentially further validated. We noted above that Shionogi’s small phase 2 trial with 56 coughs/hr at baseline resulted in a 32% reduction in cough frequency vs. placebo. They also reported 6.5% taste-related side effects, suggesting this drug could become a legitimate competitor to BLU-5937 in the large RCC market, as another agent that could provide benefit with a low rate of side effects for high cough frequency patients. However, there are a few important caveats limiting a direct comparison using this Phase 2 trial data. The previous sivopixant study was run only in Japan, while RELIEF was run in multiple sites (in the US and the UK), and it is known that US and EU patients tend to report side effects more often than Japanese patients. Given that BLU-5937 is 6 times more selective for P2X3 receptor than sivopixant, it remains to be seen whether the benign side effect profile will hold up for Shionogi or prove to be inferior to BLU-5937.

The upcoming Shionogi trial readout is from a much larger dose-ranging Phase 2b study with over 400 patients, and while it includes many patients from sites in Japan, there are also many US and EU sites enrolling patients. In the upcoming readout, we will keep our eye on the side effect rates at each of the 3 doses Shionogi is testing.

Merck’s gefapixant has a March 21, 2021, PDUFA date with an AdCom anticipated in December or January. This AdCom will shed light on the overall P2X3 drug class and expert opinion on its use in this indication. No doubt the taste side effects of gefapixant will be thoroughly discussed. Gefapixant is likely to be the first ever drug approved for refractory chronic cough and also the first drug approved for cough in general since dextromethorphan (cough syrup) in the 1960s. This is likely to generate significant medical, industry and media attention to the condition and P2X3 class.

Lastly, while our eyes are focused squarely on the chronic cough readout, there is a potential additional upside catalyst for BLU shares with an anticipated readout for BLU-5937 in chronic itching due to atopic dermatitis in Q4. This is BELLUS Health’s first among many anticipated follow-on indications for BLU-5937, and the mechanistic rationale for P2X3 signaling in chronic itching appears sound with BLU-5937 showing impressive results in a published preclinical study utilizing a mouse model of atopic dermatitis. This upcoming readout will be from a small placebo-controlled Phase 2 trial in 128 subjects aimed at proof of concept for BLU-5937 via a demonstration of improvement from baseline in WI-NRS (worst itch numerical rating scale) compared to placebo.

BLU – The Opportunity: A Valuation and Stock Price Practically Dismissing the Potential for a Positive Outcome

Prior to the RELIEF trial readout, BLU traded at $12 per share. The failure of RELIEF resulted in a massive decline in the stock price and the ground floor valuation we observe today. The stock now trades in the US$2.75 range and is valued at only ~$215M in market cap. This discount reflects heavy pessimism about BLU-5937’s future, and contrary to our view, the market likely expects the SOOTHE Phase 2b trial to fail. We have outlined many reasons why in this case the failure of the Phase 2 RELIEF trial should NOT predict a failure in the next trial and why we believe there is a strong chance of success going forward. In light of the market pessimism, a positive trial outcome would not only put BELLUS Health back onto the map for eventually treating chronic cough commercially, but it should result in a large spike in the share price with a high degree of upside from current levels. Recall that Merck originally purchased Gefapixant in a $500M upfront cash buyout deal of Afferent Pharmaceuticals, with a potential total deal price of $1.25 billion contingent on additional future milestones. A successful readout in Q4 will make BLU stock an easy multi-bagger with additional upside. A positive interim analysis in Q3 would be a prelude to this result and should be bought aggressively.

The addressable refractory chronic cough market is massive (estimated at 9 million patients), and we expect there will be room for multiple P2X3 drugs in the space to address the large unmet need. Merck is likely to reach the market first with gefapixant, but they will help establish and grow the overall market, and this will allow additional players such as BELLUS Health to follow with a drug that has an improved safety profile more preferable to patients. KOL feedback suggested with a strong degree of certainty that patients will readily switch to a more pleasant drug with less taste-related toxicity if efficacy can at least be matched. And we already know that gefapixant set a low bar for efficacy. After establishing efficacy, the greater selectivity of BLU-5937 and its low incidence of taste-related side effects will put BELLUS Health in the driver seat to run a Phase 3 program and then enter the marketplace with a differentiated molecule. The revamped clinical strategy has improved the odds of success, and we don’t believe that stratifying the trial with a minimum awake cough frequency threshold will meaningfully decrease the total addressable market or BLU-5937‘s commercial prospects. Almost all of the patients who seek treatment have cough frequencies above 20 coughs/hr, and measurement of cough frequency is used in the research setting but is not something that is typically done clinically by doctors in the treatment setting. It has also become clear that gefapixant’s benefit does not occur in patients with low awake cough frequency, so Merck would be unable to differentiate the drug commercially along these lines, even if such patients could be tracked down and targeted for treatment.

We see BLU as a compelling investment with large near-term upside and strong odds of success. BLU-5937 if approved has the potential for peak sales of over $850M in RCC and over $350M in chronic pruritus. If BLU-5937 establishes a compelling case for future approval and market uptake with its data updates, BELLUS Health would have a strong chance of being acquired by a big pharma looking for a growth story, and the valuation of $1.25B set by Merck in acquiring gefapixant would be in play.

Disclosure: Author is LONG BLU