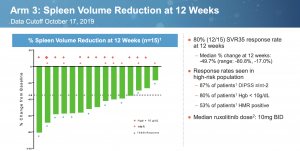

Constellation Pharmaceuticals presented some compelling data at ASH. In early results from 15 JAKi naive Myelofibrosis patients treated with a combination of BET inhibitor CPI-0610 and ruxolitinib, 12 (80%) achieved a Spleen Volume Response of at least 35% (SVR35). The numbers indicate 8/11 (73%) of the newly added patients had a response. This is a slight drop from the 100% in 4/4 patients described in the abstract, but it was to be expected.

The results compare favorably to studies of ruxolitinib alone. In three randomized trials, rux produced SVR35 at 24 weeks of 42% in COMFORT-1; 28% in COMFORT-2; and 29% in SIMPLIFY-1, which was a head to head trial against momelotinib.

The main caveat is these large studies only enrolled later stage patients with a Dynamic International Prognostic Scoring System (DIPSS) score of Intermediate-2 or High-risk while CNST also included DIPSS Int-1. In general, those with a lower score, and therefore a lower disease burden, have better outcomes.

The most comparable trial based on DIPSS status is ROBUST, run in the UK [link].

DIPSS ROBUST (n=48) CPI-0610 (n=30)

Int-1 14(29%) 9(30%)

Int-2 13(27%) 17(57%)

High-risk 21(44%) 4(13%)

In the ROBUST study, 19 of 48 (39.6%) patients, achieved at least 50% reduction in spleen length- which roughly corresponds to 35% SVR. By baseline status, response rate was 50% Int-1; 15.4% Int-2; and 47.6% High-risk. Depending on how you look at the data, DIPSS status may have some correlation with spleen response. While High-risk patients did just as well as Int-1, Int-2 underperforms the lower risk group by far.

The ruxolitinib P3b expanded access JUMP trial included 163 Intermediate-1 patients out of 1144 total, amounting to 14.2% [link]. A subset analysis found 63.8% of Int-1 had at least 50% spleen reduction compared to 56.9% for all patients at 24 weeks. By 48 weeks, the rate was 60.5% vs 62.3%, respectively.

If there is a difference in spleen response based on DIPSS risk factor, I believe it is small. In a trial with a mix of patients, I doubt it would be discernible. Across these five named trials, the average spleen response rate (or 50% spleen length reduction) is 39.1%.

CPI-0610 with ruxolitinib in JAK inhibitor naive patients has an SVR35 that is double what has been observed in the clinical setting for ruxolitinib alone. The numbers are likely to come down some more in a large trial, to be sure, but a true response rate ranging all the way down to 60% should remain sufficient for superiority against ruxulitinib. The JUMP study has an unusually high response rate not replicated in other trials.

There are suggestions that rux alone is responsible for these results. One must consider that not only are a much higher proportion of patients achieving SVR35, but responses are also deeper. Median spleen volume reduction in COMFORT-1 was 31.6% while the combination resulted in a 49.7% decrease. Rux would also need to accomplish this at a lower dose. The median dose in COMFORT-1 and 2 was ~30mg BID, compared to 10mg BID in the CPI-0610 combination study.

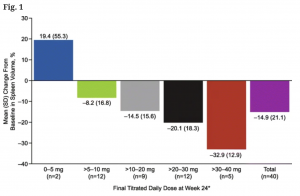

We may not know what clinical characteristics predispose patients for a spleen response, but we do know it is highly dose-dependent. In a study on alternative dosing schemes, researchers found, not too surprisingly, that spleen volume shrank more with higher total daily doses of rux [link]:

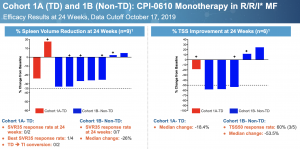

Perhaps we can still pin the activity on ruxolitinib if CPI-0610 has no single agent activity, as many suggest, except that is not the case. This is a slide from Constellation’s ASH presentation for the monotherapy arms in Relapsed/Refractory MF. Cohort 1A is transfusion dependent, Cohort 1B is not.

No patients achieved SVR35, the gold standard for spleen response. This should not take away from the fact that most patients saw their spleens shrink substantially and a majority had more than 50% improvement in Total Symptom Score (TSS) in difficult to treat R/R patients. By comparison, momelotinib only managed a 26.5% TSS50 response in JAK inhibitor naive patients despite inducing 26.5% SVR50 [link]. The compound certainly has single agent activity; whether it is sufficient for approval is another story.

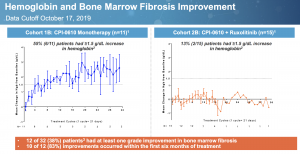

A notable aspect of CPI-0610 is its ability to increase hemoglobin, shown here:

55% of patients had at least 1.5g/dL hemoglobin increase with monotherapy treatment while levels were flat in the combination arm. Lack of change in combination with ruxolitinib may be due to the JAK inhibitor’s countering anemia effect. Only an active molecule will reduce spleen, improve symptoms, and increase hemoglobin.

Constellation has expanded the JAK inhibitor naive combination treatment arm to 101 patients. The cohort of CPI-0610 plus ruxolitinib in JAKi experienced transfusion dependent patients was expanded to 60 patients. A randomized head to head trial is planned for 2020.

I do not believe the pivotal trial will need to be very large. It appears the study will be designed to mirror previous randomized ruxolitinib trials, which should narrow the possible outcome. SVR35 for ruxolitinib alone should come in somewhere between 30% to 40%, closer to 30%. This leaves a lot of wiggle room for the combo arm.

The company announced it has priced an upsized offering of 6.5M shares at $34.5/sh, raising net proceeds of $224.3M, only a buck shy of today’s closing price. Constellation had only $90M in cash at the end of the third quarter and will soon be spending heavily on a pivotal trial.

I expect the stock to rise as additional data become available to confirm efficacy and durability.

Did I say bull case in a single slide? It’s the first one.

Author is Long CNST