I’ve primarily been focused on biotech stocks and have generally avoided medical device investments. But a month ago, a broker I’ve worked with for years called me about a new opportunity. He knows I’m selective, but he was excited about the company and wanted my take on their public financing round.

When he mentioned it was a medical device company, my first reaction was, “Pass.” But he pushed back, saying, “Joe, hear me out, this is a compelling story.” He explained that a major U.S. fund was backing the deal, willing to commit over $15 million if the company upsized its financing from $3–4 million to $20 million. That got my attention. I asked for more details to conduct due diligence and determine whether I’d take a small stake or start building a larger position.

Conavi Medical Inc. (CNVI: TSXV & CNVIF: OTCQB) listed on the TSX Venture Exchange (TSXV) in October 2024 after completing a reverse takeover with Titan Medical Inc., marking its debut as a public company in Canada. Conavi operates mainly in Canada and has a low-volume OTCQB listing in the US, but lately the volume started expanding post the $20M financing. Conavi focuses on the development of advanced imaging for use in minimally invasive cardiovascular procedures. The Novasight Hybrid System, their flagship product, integrates two imaging modalities—intravascular ultrasound (IVUS) and optical coherence tomography (OCT), to simultaneously and precisely image the coronary arteries.

Conavi Medical completed a business combination with Titan Medical Inc. in October 2024, which was structured as a reverse takeover. As part of this transaction, Conavi conducted a private placement of subscription receipts, raising C$7.7 million. The deal resulted in Titan Medical Inc. being renamed Conavi Medical Corp., with a focus on commercializing Conavi’s Novasight Hybrid™ System for guiding minimally invasive coronary procedures.

Conavi Medical Corp. announced the closing of its $20 million public offering on April 23, 2025. The financing was upsized from its original plan, with proceeds aimed at advancing the development and pre-clinical testing of its Novasight 3.0 technology. The company intends to submit a 510(k) clearance application to the U.S. Food and Drug Administration (FDA) in Q3 of 2025.

Bloom Burton Securities Inc. acted as the sole and exclusive agent for the offering, which included common shares priced at $0.40 and pre-funded warrants at $0.39999 per unit. Investors purchased a total of 50 million securities, consisting of 32.5 million common shares and 17.5 million pre-funded warrants.

The Novasight Story: A Game-Changer in the Making

What really caught my eye is the Novasight Hybrid System’s journey and potential. Conavi got the first-generation Novasight approved by the FDA in 2018, with additional approvals from Health Canada, Japan, and China’s regulatory bodies. By 2022, they secured further regulatory clearance, and the system was being used at seven top-tier luminary sites, where leading cardiologists tested its capabilities in real-world settings. A 2021 study praised its single-catheter design for reducing procedural time and improving outcomes in complex cases, like chronic total occlusions, compared to standalone IVUS or OCT systems. These early adopters provided critical feedback, helping Conavi refine the technology.

In 2022, Conavi kicked off development of the next-generation Novasight, aiming to build on the first-gen’s success. By 2024, they’d made significant technical enhancements, incorporating customer feedback to improve performance and usability. They also completed the development of this next-gen system, setting the stage for its launch. Looking ahead, Conavi plans to wrap up usability testing and system validation with key opinion leaders (KOL), followed by a U.S. FDA 510(k) submission for the next-gen Novasight in Q3 2025. If all goes well, they’re targeting a U.S. commercial launch in early 2026, which could be a major milestone for the company.

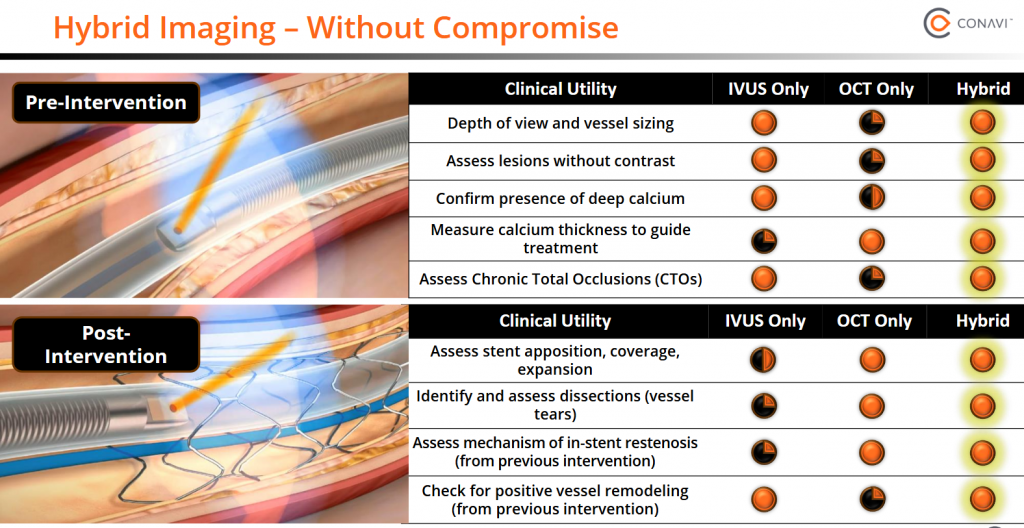

This hybrid system’s ability to combine IVUS and OCT is what sets it apart from competitors like Abbott and Boston Scientific, who offer standalone IVUS or OCT systems. New U.S. guidelines (March 2025) and European guidelines (2024) endorsing IVUS and OCT as complementary tools further validate Novasight’s approach, with Conavi expecting broader global adoption. Novasight’s unique edge makes it a go-to tool for complex cardiovascular procedures, and its ongoing evolution shows Conavi’s commitment to staying ahead of the curve.

Why I’m Excited About the Hybrid Approach

The idea of combining IVUS and OCT into one system is brilliant, it’s like giving surgeons the best of both worlds. A 2021 study highlighted how Novasight’s single catheter delivers real-time, co-registered images, simplifying decisions and reducing risks like target vessel failure in percutaneous coronary interventions (PCI). Here’s a quick breakdown of what each technology brings:

Advantages of IVUS:

- Deeper Imaging: Uses sound waves to see deeper vessel layers, perfect for assessing plaque buildup and vessel structure.

- Calcified Plaque Detection: Excels at spotting tough, calcified plaques that OCT might miss.

- Stent Guidance: Helps surgeons choose the right stent size and placement by showing vessel size and plaque details.

Advantages of OCT:

- High-Resolution Images: Uses near-infrared light for ultra-clear visuals (10–20 microns), ideal for seeing fine details like stent struts or blood clots.

- Inner Vessel Clarity: Great for checking stent placement and vessel surfaces.

- Fast Imaging: Delivers quick, detailed images during procedures.

Why Surgeons Choose One Over the Other:

- IVUS shines when deeper analysis is needed, like evaluating plaque or vessel remodeling. It’s often used before treatment to assess blockages safely.

- OCT is the go-to for high-resolution needs, like checking stents post-implantation, especially in cases prone to complications like dissections.

Conavi’s Novasight hybrid system lets surgeons use IVUS to plan interventions and OCT to fine-tune results, like spotting issues after stent placement. Clinical data from 2021 showed it reduced risks like target vessel failure compared to older imaging methods, making it a standout for complex procedures. “Source: Ma, T., et al. (2021). Multi-modality intravascular imaging for guiding coronary intervention and assessing coronary atheroma: the Novasight Hybrid IVUS-OCT system. ResearchGate”

Financing, Stock Performance, and Market Position

Conavi Medical has made significant financing moves recently. In Q1 2025, the company filed a preliminary short form prospectus with offering of units, marking its first public company prospectus. This triggered a full review by the Ontario Securities Commission (OSC), ensuring compliance with disclosure rules for new public issuers.

Following this, Conavi upsized its financing with a $20 million CAD public offering announced in April 15, 2025, and closed on April 23rd, at a price of $0.40 per Common Share, which has successfully closed. The proceeds are earmarked to advance and complete the development and pre-clinical testing of its Novasight 3.0 technology, with the goal of submitting a 510(k)-clearance application to the U.S. Food and Drug Administration in Q3 of 2025.

Financial Performance

- Revenue: Conavi reported $8.6 million in Q1 2025, boosted by a $5.9 million milestone payment from its Chinese partner, East Ocean Medical, for Novasight-based tech approval in China.

- Stock Performance: The stock (CNVI: TSXV) was ranked among the top 10 undervalued healthcare stocks on the TSX Venture Exchange in April 2025, suggesting it’s trading below intrinsic value.

- Market Access: Conavi’s uplisting to OTCQB in March 2025 improved U.S. investor access, but the trading volume remains lower than the Canadian side, though volume started expanding after the $20million financing closed.

Competitive Position

Conavi faces competition from Abbott and Boston Scientific, which lead with standalone IVUS and OCT systems. However, Novasight’s dual-modality catheter remains unique. Abbott’s Dragonfly OCT and Boston Scientific’s Polaris IVUS don’t offer integrated imaging. A 2021 study suggested Novasight could set a new standard for percutaneous coronary interventions (PCI), though cost and adoption challenges persist.

Adding to the competitive landscape, Spectrawave, a Massachusetts-based medical imaging company, has emerged as a strong contender. In September 2024, Johnson & Johnson Innovation (JJDC) led a $50 million Series B funding round to support Spectrawave’s HyperVue intravascular imaging system. HyperVue integrates DeepOCT and near-infrared spectroscopy (NIRS), offering contrast-free saline imaging and AI-driven workflows to enhance procedural efficiency. The system received FDA 510(k) clearance in March 2023, followed by additional approvals for advanced AI algorithms.

Spectrawave’s AI-enhanced imaging and contrast-free technology may challenge Conavi’s hybrid IVUS-OCT approach, particularly in coronary artery disease interventions. However, Conavi’s dual-modality catheter remains distinct, as no competitors have launched a similar hybrid system since 2021.

Since 2021, no competitors have launched hybrid systems based on available data. Conavi’s collaboration with Minnetronix Medical (January 2025) refined Novasight’s design. Additionally, new intravascular imaging guidelines in Europe (2024) and the U.S. (2025) endorse IVUS and OCT, boosting Novasight’s market relevance, with Conavi anticipating further global guideline support.

Strategic Landscape Driving Acquisition Potential

-

Large Strategic Medtech Companies:

-

Johnson & Johnson: J&J’s $16.6 billion acquisition of Abiomed (cardiovascular devices) and $13.1 billion purchase of Shockwave Medical (intravascular lithotripsy) in 2024 demonstrate its focus on expanding its cardiovascular portfolio. Conavi’s imaging technologies could complement J&J’s Biosense Webster electrophysiology business and enhance its minimally invasive procedure offerings.

-

Boston Scientific: With a history of acquiring cardiovascular and endoscopy companies (e.g., Apollo Endosurgery for $615 million), Boston Scientific could integrate Conavi’s Novasight and Foresight systems to strengthen its interventional cardiology and structural heart portfolios.

-

Abbott: Abbott’s focus on cardiovascular devices, including stents and imaging, makes Conavi’s hybrid imaging systems a strategic fit to enhance its diagnostic and procedural capabilities.

-

Medtronic: Although Medtronic called off acquisitions in 2023, its interest in cardiovascular innovation could make Conavi’s cost-effective ICE system attractive for expanding its structural heart offerings.

-

Philips: Known for its imaging and ultrasound technologies, Philips could acquire Conavi to integrate its hybrid IVUS-OCT system into its cardiovascular imaging portfolio, enhancing its market leadership in interventional imaging.

-

-

Private Equity Firms:

-

Arcline Investment Management, Summit Partners, and Ampersand Capital: These firms are active in medtech M&A, with nine transactions each in recent years. Conavi’s high-growth potential and recurring revenue from royalties make it an attractive target for PE firms seeking scalable platforms or add-on acquisitions.

-

Francisco Partners: Its $1.1 billion acquisition of AdvancedMD (healthcare IT) in 2024 shows interest in technology-driven healthcare solutions. Conavi’s imaging systems and IP portfolio could align with its investment strategy.

-

PE firms could view Conavi as a platform for further consolidation in the cardiovascular imaging space or as a candidate for a take-private deal, given its recent public TSXV listing in October 2024.

-

-

Specialized Cardiovascular Companies:

-

Terumo Corporation: A Japanese company with a strong presence in cardiovascular devices, Terumo could acquire Conavi to strengthen its imaging capabilities and leverage its existing distribution network in Japan.

-

Canon Medical Systems: With a focus on diagnostic imaging, Canon could integrate Conavi’s hybrid imaging tech

-

What’s Next?

Conavi’s $20 million raise, plus its undervalued stock status, make it an intriguing prospect. However, low trading volume and competition from bigger players remain at risk, while patience is needed to get a full position.

The Q3-2025 FDA submission for Novasight 3.0 is another key milestone, if approved, it could drive growth, especially with supportive imaging guidelines.

Disclosure: Author is Long CNVI in the Canadian market.

Citations:

- Ma, T., et al. (2021). Multi-modality intravascular imaging for guiding coronary intervention and assessing coronary atheroma: the Novasight Hybrid IVUS-OCT system. ResearchGate.

- Conavi Medical Secures $20M to Advance Cardiovascular Imaging Technology. TipRanks. April 23, 2025.

- Conavi Medical Corp. Announces Public Offering to Fund Novasight 3.0 Development. TipRanks. April 15, 2025.

- Conavi Medical Reports Fiscal Q1 2025 Interim Financial Results and Operational Highlights. BioSpace. March 4, 2025.

- Conavi Medical Revenue Jumps to $8.6M in First Quarter as Public Company. StockTitan. March 3, 2025.

- Conavi Medical: Top 10 Undervalued Healthcare Stocks on TSX-V (CNVI). Barchart. April 15, 2025.

- Conavi Medical Secures OTCQB Uplisting Ahead of Major Product Launch. StockTitan. March 6, 2025.

- Conavi Medical Highly Encouraged by New U.S. Intracoronary Guidelines. Yahoo Finance. March 4, 2025.

- Conavi Medical and Minnetronix Medical Publish In-Depth Collaboration Review. Business Insider. January 7, 2025.

- Filing a prospectus in Ontario. OSC. February 19, 1998.