Eupraxia Pharmaceuticals Inc. (EPRX – Nasdaq and TSX) is a clinical-stage biotechnology company headquartered in Victoria, British Columbia, Canada. The company focuses on developing locally delivered, extended-release alternatives to currently approved drugs. Their goal is to provide targeted, long-lasting activity with fewer side effects. Eupraxia’s lead product candidate, EP-104GI for treating eosinophilic esophagitis (EoE). EoE is a chronic, immune-mediated condition where white blood cells accumulate in the esophagus, causing inflammation, pain, and difficulty swallowing.

Previously, provided an in-depth look at Eupraxia’s promising pipeline (LINK) and the anticipated EP-104GI trial readout from Cohort 7 in Q2-2024 assessing EP-104GI in EoE patients. Now, with positive interim data from Cohort 6 and the 24-week follow-up results from Cohort 5, it’s the perfect time to revisit the story. The latest results confirm what was hoped and predicted: the precise, localized delivery of EP-104GI at higher doses continues to drive significant improvements in both esophageal tissue health and symptom reduction. Notably, no serious adverse events or cases of oral or gastrointestinal candidiasis, common in EoE steroid treatments, were reported in any of the first six cohorts.

Judging by the stock’s price reaction, the market seems to be starting to take notice of Eupraxia’s potential. However, it remains under the radar for many biotech-focused investors, leaving an opportunity for those who are informed.

Following the data release, Eupraxia hosted a webinar to discuss the findings and outline the next milestones. For those considering a position in EPRX, this webinar offers valuable insights into the newly released data from Cohort 5 at 24 weeks and Cohort 6 at the 12-week follow-up.

Link: https://www.youtube.com/watch?v=Oboq9Lc9fHM

EPRX’s EoE Breakthrough

This week, EPRX presented compelling new findings from Cohorts 6 and 5 of its ongoing RESOLVE trial for EP-104GI, a promising treatment for eosinophilic esophagitis (EoE), and walked us through the details in a webinar that had me taking nonstop notes. The RESOLVE study, a Phase 1b/2a study, is multicenter, open-label, and all about escalating doses to find the recommended dose for the next study.

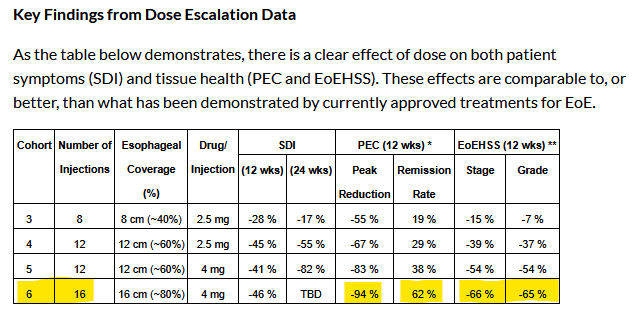

The study is evaluating EP-104GI if it is safe, tolerable, and effective for adults with active & confirmed EoE via histology assessment. The spotlight was on Cohort 6 (16 shots of 4mg each) across three big markers: Symptom Dysphagia Index (SDI), EoE Histology Scoring System (EoEHSS), and Peak Eosinophil Count (PEC), reinforcing a clear and consistent positive trajectory.

The takeaway – the data underscores a strong dose-response relationship, positioning EP-104GI as a potential leader in EoE management.

Eupraxia’s CEO explained at the webinar opening:

“Precision matters, that means that you have to be precise about the drug you are using, the dose you’re using and where you’re putting it. You want it in the right tissue at the right dose for the right length of time. And this DiffuSpher allows us to do that. These particles are about the size of a grain of sand, they are 100 microns in size and they are placed throughout the esophagus by injection into the submucosa, there they deliver the drug in a very stable flat fashion, that enables us to deliver the drug to the tissues that need treatment and not to the tissues that don’t need treatment. So, it is precise in its locality, it is precise in its duration, and it is precise in its dose.”

Every metric is trending up—way up—and it’s clear that more dose and more coverage mean better results as you can see from the table attached including the data from Cohort-3 and up to Cohort-6.

The Cohort 6 outcomes are particularly noteworthy, achieving improvements that meet or exceed those of existing FDA approved therapies, such as Dupixent and Eohilia. And with that dose-response pattern locked in, I’m already circling Cohort 7 (20 injections at 4mg) which is fully enrolled as the CEO mentioned, on my calendar for its 12-week data drop in 2Q25. Eupraxia is already recruiting patients for the next Cohort 8 (20 injections at 6mg) and will be the final cohort in this study.

Additionally, EPRX highlighted impressive 6-month data from Cohort 5, reflecting the most significant symptom relief observed to date and suggesting durable long-term benefits. Further insights are anticipated in Q2 2025, including 9-month data for Cohort 5, where they will have both PEC and EoEHSS data as well from biopsy taken on 9-months point, and 6-month data for Cohort 6 with 24-weeks follow-up.

Looking ahead, EPRX plans to initiate a Phase 2b a placebo controlled study in mid-2025, with the recommended and optimized dose from Phase 1a/2b. Eupraxia is looking for the duration and hoping for a perfect once-a-year use, targeting topline data by mid-2026. Importantly, EP-104GI’s safety profile remains exemplary despite escalating doses.

Let’s break down Cohort 6

This cohort received 16 injections, 4mg each, hitting a solid 64mg total and covering about 80% (16cm) of the esophagus’s lower three-quarters. EoEHSS Composite Stage and Grade scores declined by an average of 66% and 65%, respectively, with peak reductions reaching 89% and 88%—the most substantial improvements recorded across all cohorts to date and competitive with approved therapies. These are the best reductions we’ve seen yet, and they’re giving approved treatments a run for their money.

Source: Euprexia’s press release

Source: Euprexia’s press release

At 12 weeks (n=3), SDI – Symptom improvement: All three patients reported reduced symptom severity, with peak SDI score reductions of up to 5 points (71%) and an average reduction of 46% (3 points) decreased by an average of 46% (3 points), with peak reductions up to 71% (5 points). While 24-week data remain pending, Cohort 5’s 82% SDI mean reduction suggests Cohort 6 could outperform expectations.

Biopsy results for cohort 6 revealed a mean 94% reduction in Peak Eosinophil Counts (PEC) at 12 weeks, with a mean 62% remission rate across all biopsy sites. EPRX ensures data reliability by collecting 16 biopsies per patient, centrally reviewed for consistency

Tissue Health (EoEHSS):

The largest improvement in tissue health observed in any cohort to date, with peak Stage and Grade score reductions of 89% and 88%, respectively, and mean Stage and Grade score reductions of 66% and 65%.

Source: Euprexia’s press release

What’s Next? Strategic Outlook

The RESOLVE trial continues to progress, with additional data releases expected roughly every three months. Cohort 7’s 12-week results are due in Q2 2025, alongside 24-week data for Cohort 6 and 9-month data for Cohort 5 (Cohorts 5 and beyond are tracked for 52 weeks). EPRX aims to finalize an optimal dose and launch a placebo-controlled Phase 2b trial in mid-2025, enrolling 60 patients across two dose levels and a placebo arm (20 patients per group). Topline results are projected for mid-2026, paving the way for an End-of-Phase 2 FDA meeting and the initiation of a registrational Phase 3 study in early 2027 (targeting 150-300 patients, placebo-controlled).

Financial Position

EPRX is well-capitalized through Q3-2026, providing a runway to complete the Phase 1b/2a, Phase 2b program and engage with the FDA discussion. Additional funding will be required later on to advance the Phase 3 trial.

Conclusion

EPRX’s latest data strengthens its case as a front-runner in EoE treatment, with EP-104GI demonstrating both efficacy and safety at levels that could redefine the standard of care. We remain highly optimistic about its trajectory.

RESOLVE study is still rolling, with fresh cuts of data popping up every three months or so. Cohort 7’s 12-week results are due in 2Q25, alongside Cohort 6’s 24-week and Cohort 5’s 9-month updates (they’re tracking Cohorts 5+ out to 52 weeks). EPRX is laser-focused on nailing the perfect dose, then jumping into a placebo-controlled Phase 2b trial mid-2025 with 60 patients, two dose groups, and a placebo arm. Expect topline results mid-2026, followed by end-of-phase 2 discussion with the FDA, and a Phase 3 kickoff in early 2027 (150-300 patients, placebo-controlled).

This feels like EPRX’s moment—EoE treatment could be in for a game-changer. We reiterate a buy rating and a U$10 TP.

Disclosure: The author is long EPRX in the US & Canada markets.