Eupraxia Pharmaceuticals Inc. (EPRX) is a clinical-stage biotechnology company headquartered in Victoria, British Columbia, Canada. The company focuses on developing locally delivered, extended-release alternatives to currently approved drugs. Their goal is to provide targeted, long-lasting activity with fewer side effects.

Eupraxia’s lead product candidate, EP-104GI for treating eosinophilic esophagitis (EoE). EoE is a chronic, immune-mediated condition where white blood cells accumulate in the esophagus, causing inflammation, pain, and difficulty swallowing.

EP-104GI utilizes Eupraxia’s proprietary Diffusphere™ delivery technology to provide extended-release Fluticasone Propionate directly to the esophagus. This targeted approach aims to reduce inflammation and improve symptoms with fewer side effects compared to systemic treatments. The company has reported positive results from its Phase 1b/2a RESOLVE trial, showing early efficacy signals and a favorable safety profile. Eupraxia plans to continue dose-escalating studies to determine the optimal dose and further evaluate long-term efficacy and safety.

The second candidate EP-104IAR, is designed to treat knee osteoarthritis (OA). Knee OA is a leading cause of disability, affecting over 30 million people in the U.S. alone. EP-104IAR aims to provide long-lasting pain relief with fewer side effects compared to current treatments.

They are also developing a pipeline of earlier-stage long-acting formulations for various indications, such as post-surgical pain and post-surgical site infections.

The company leverages its proprietary Diffusphere™ delivery technology to ensure the right dose of drug is delivered to the right place for the right amount of time. This technology aims to address therapeutic areas with high unmet medical needs.

Eupraxia Pharmaceuticals’ Diffusphere™ delivery technology is designed to provide precise, localized, and extended drug release. Here’s how it works:

- Microsphere Composition: The technology uses a microsphere composed of a pure drug crystal encased in a microns-thick polymer shell.

- Controlled Release: The polymer shell is engineered to release the drug at a pre-defined rate. As the inner drug core dissolves, it creates a saturated solution inside the membrane, which then releases the drug at a constant rate until the drug is depleted.

- Targeted Delivery: By delivering the drug directly to the target tissues, Diffusphere™ minimizes systemic exposure and potential side effects.

- Extended Duration: The technology aims to maintain therapeutic drug levels for an extended period, which can be particularly beneficial for chronic conditions.

This innovative approach ensures that patients receive the right dose of the drug in the right place for the right amount of time, potentially improving efficacy and reducing side effects.

So, what is Eosinophilic Esophagitis or EoE?

We’ll call it EoE to simplify things. EoE is a disorder that affects the esophagus, the food pipe that connects the back of our throat and mouth to the stomach. The term “eosinophilic” refers to a type of white blood cell, eosinophils, which attack the esophagus and cause inflammation, known as esophagitis. In EoE, these white cells trigger an allergic reaction in the esophagus, leading to stickiness, swelling, and inflammation, which can impair the food pipe’s flexibility. Normally, the esophagus is like a rubber tube that can expand and contract, but with EoE, scar tissue can form, making it difficult for the food pipe to stretch. This often results in difficulty swallowing or pain while swallowing.

Many patients might not be aware they have EoE, as it’s not well diagnosed, and symptoms can vary between adults and children. Let’s break it down:

Children:

Children often will have different experiences than adolescents and adults, they may present these symptoms

- Difficulty swallowing, pickiness with food

- Vomiting and abdominal pain

- Growth failures or malnourishment due to reluctance to eat

- Rhinoconjunctivitis (runny nose and inflammation in the ear, nose, and throat area)

Children may not initially see a gastroenterologist. Instead, they might first visit an ear, nose, and throat specialist before being referred to a gastroenterologist.

Adolescents and Adults:

- Difficulty swallowing, often misattributed to chewing too quickly or swallowing too fast

- Sensation of food getting stuck in the chest or feeling pressure

- Adjusting lifestyle habits, such as avoiding eating in public, sticking to soups or liquids, or being the last to finish a meal due to the need for frequent lubrication with liquids

For both children and adults, EoE can significantly impact not only physical health but also social interactions, as food is a big part of our lives.

Certain foods can trigger EoE symptoms, such as meats, dry foods like bread, and sticky foods like cinnamon buns. Inflammation in the esophagus can cause stickiness in the lining, making it hard for dry foods to go down and causing food impactions, which is a medical emergency requiring immediate attention.

EoE Market and approved drugs:

Current treatment options for eosinophilic esophagitis (EoE) typically involve a combination of dietary management, medications, and in some cases, procedures. Here are the main approaches:

- Dietary Therapy: Identifying and eliminating food triggers is a common approach. This may involve an elimination diet, where common allergens like dairy, wheat, soy, eggs, nuts, and seafood are removed to pinpoint specific triggers. In some cases, an elemental diet, consisting of hypoallergenic nutrition, may be used.

- Proton Pump Inhibitors (PPIs): These medications, which are effective acid blockers, are often the first line of treatment. PPIs can help reduce eosinophilic inflammation in the esophagus. Patients may need to take higher doses or take the medication twice daily.

- Topical Steroids: If PPIs are not effective, topical steroids like fluticasone or budesonide may be prescribed. These are swallowed rather than inhaled, targeting the esophagus directly.

- Esophageal Dilation: For patients with significant narrowing of the esophagus, a procedure called esophageal dilation may be performed to widen the esophagus and improve swallowing.

- Biologic Drugs: Recently, biologic drugs like dupilumab (Dupixent) have been approved for treating EoE. These drugs target specific inflammatory pathways and are administered via injection.

- Allergy Management: Since EoE is often linked to food allergies, working with an allergist to manage and treat these allergies can be beneficial.

Each patient’s treatment plan is tailored to their specific needs, and it may require some trial and error to find the most effective approach.

There are only two drugs approved for the management of EoE, Sanofi (SNY) / Regeneron’s (REGN) Dupixent was approved for the treatment of eosinophilic esophagitis (EoE) on May 4, 2023. This marked an important milestone as it was the first biologic therapy approved for managing EoE. The FDA approved Takeda Pharmaceutical’s (TAK) Eohelia on February 9, 2024. It’s the first and only FDA-approved oral therapy for EoE in patients aged 11 and older. The pivotal studies for these drugs had co-primary endpoints of histological response, measured by eosinophil count, and symptom response, indicated by patient-reported difficulty swallowing (dysphagia) scores.

An “ideal” EoE therapy would be:

- safe/without side effects

- easy/tolerable to administer

- effective in treating the disease on several measures (SDI/DSQ/DD, PEC and EoEHSS)

- readily covered by insurers

The takeaway from what is available these days is that none of the products in development or that are approved, score well on ALL these criteria, underscoring the relative openness of the market.

This sparse field of viable therapies, and the recognition that EoE is a highly under-diagnosed condition (and therefore has a much larger patient population than what is officially reported), explain the active interest from Big and Specialty Pharma in this indication.

What differentiates Eupraxia’s technology from other approved or in-development drugs?

Eupraxia’s Diffusphere technology is an injectable microsphere technology that enables physicians to deliver drugs into targeted tissues over a very long period of time at constant levels.

Injectable microspheres are small particles that can be injected into small spaces that cannot be accessed with a pump, such as into the knee for OA, into the submucosal space for EoE, into a lesion, or into a tumor for solid cancer. Injecting the drug locally enables high concentrations of the drug in the targeted area, with very low levels in the rest of the body. While there have been other injectable microspheres in development for quite some time, what sets Eupraxia’s technology apart is its ability to deliver drugs over a very long period (6-12 months, compared to 6-12 weeks) and at a very constant rate. This unique profile enables Eupraxia to achieve a therapeutic response that is not possible with other technologies.

Eupraxia’s EP-104GI is positioned as an ideal candidate to address the debilitating symptoms of EoE, and is designed to slowly release drug to affected areas, maximizing therapeutic action at the site and minimizing undesirable effects that is more common with systemic applications via injection or swallowing. For patients with EoE, this means potential for longer-lasting, effective intervention that is anticipated to be a well-received alternative to current options.

Procedure for Administering Drugs Using Eupraxia’s Diffusphere™ Technology

The procedure to inject Eupraxia’s drug using their Diffusphere™ technology involves a minimally invasive and painless endoscopic approach. Here’s a step-by-step overview:

- Preparation: The patient undergoes a standard endoscopy preparation, which may include fasting and sedation to ensure comfort during the procedure.

- Endoscopy: A flexible endoscope is inserted through the patient’s mouth and guided down the esophagus to the target area.

- Injection: Using the endoscope, the physician injects the Diffusphere™ microspheres containing the drug directly into the submucosal layer of the esophagus. Multiple injections may be administered at different sites to ensure even distribution.

- Post-Injection Monitoring: After the injection, the patient is monitored for any immediate adverse reactions. They may be advised to avoid certain foods or activities for a short period.

- Extended Drug Release: The Diffusphere™ microspheres slowly release the drug over an extended period (6-12 months), providing a steady therapeutic effect with minimal systemic exposure.

This targeted approach allows for high drug concentrations at the site of inflammation while reducing the risk of systemic side effects, making it a promising treatment for chronic conditions like EoE.

Data status of EoE programs

- Sanofi – Dupixent (FDA approved for EoE)

– Monoclonal antibody

– 1x per week injection, systemic therapy (affects interleukin receptors throughout the body)

– active patients showed a 60% PEC response rate (complete histologic response, see above)

– active patients showed a 26% reduction in DSQ scores

– only 13% of patients show both histologic response AND patient-reported outcome (DSQ)

– reduction from baseline in EoEHSS stage & grade of -0.25 & -0.25

– side-effects > injection site reactions very common (17%), arthralgia/musculoskeletal pain also occurs

– $100k USD per year is a problem for payers, especially with only 13% feeling and getting better

- Takeda – Eohelia (FDA approved for EoE)

– Swallowed steroid slurry (budesonide, residual steroid ingested after passing esophagus)

– 2x daily, cannot eat/drink for 2 hours after taking

– Approved, but not recommended for more than 12-weeks of use by FDA due to side-effects, DSQ inadequacy

– active patients showed a 53% PEC response rate

– active patients showed only a 15% reduction in DSQ scores

– reduction from baseline in EoEHSS stage & grade of -0.20 & -0.22

– no statistical difference vs. placebo in DSQ score for 24 weeks

– side-effects – candidiasis in the mouth

– have announced that no follow-on study is coming

– reimbursement approval rates are low due to 12-week use label restriction

- Celgene/Bristol Myers Squibb – Cendakimab, Phase 3

– monoclonal antibody

– 1x per week injection, systemic therapy (affects immune response mediators throughout the body)

– large study (400+ patients) – larger than Dupixent study

– only 28% of active patients showed PEC response rate (much lower than Dupixent)

– no SDI or DSQ scores > used “Dysphagia Days” (easier test to pass)

– despite using DD, active patients only saw a reduction of 6.1 days vs reduction of 4.2 days for placebo (FDA unlikely to see as clinically meaningful)

– EoEHSS scores similar to Dupixent

– unlikely to move to approval

- Pfizer – Etrasimod, Phase 2

– phosphate receptor modulator, modifies the activity of the immune system, (affects the whole body)

– approved for used in ulcerative colitis

– oral tablets, 1x per day

– 110 patients in Phase 2

– only 25% of active patients showed PEC response rate

– active patient DSQ WORSE than placebo for most of the 52-week study

– highly unlikely to proceed to Phase 3

- Ellodi – Phase 3

– slowly dissolving steroid tablet (fluticasone)

– 1x daily in Phase 3, cannot eat/drink for 2 hours after taking

– phase 3 read out in mid-August, no news posted

– reminder that in Phase 2, the 2x daily arm results showed good efficacy, but intolerable levels of candidiasis in the mouth; Phase 3 reverted to 1x daily as a result, which had marginal efficacy

– data read-out in August, and has not been released – 5 months and no announcement- usually a very bad sign

– have not attended the last 2 major GI conferences after August (Vienna and Washington); had been present & active at every prior GI conference pre, and during, phase 3

key variables used to assess the efficacy of an EoE therapy

1. Patient-reported data (“how much the patients are feeling better”, which can have a placebo effect)

– SDI (Straumann Dysphagia Index), DSQ (Dysphagia Symptom Questionnaire) – composite scores of how much it hurts, and how hard it is to swallow – measured in change from baseline

– DD (Dysphagia Days) – number of days over a specified period (typically 2 weeks) where patients are not experiencing dysphagia (pain/discomfort)

– SDI & DSQ are seen as more rigorous measures, and somewhat comparable to each other; Dysphagia Days is seen as less rigorous

– only one is typically used in a given trial

2. Histologic Data (measuring improvement in tissue health, obtained by biopsy – no placebo effect)

– EoEHSS (Eosinophilic Esophagitis Histology Scoring System) is a composite score of various histological inflammatory measures – split into separate metrics of “stage” (extent) and “grade” (severity) – a score of 1.0 is highly inflamed, a score of 0 is normal/healthy tissue

– PEC (Peak Eosinophil Count) – reported as a % reduction in eosinophils or as the % of people who have “complete histologic response” (eosinophil count < 6 eosinophils per microscopic field)

– Because of the cut-off threshold for a “complete histologic response”, scoring reported from PEC can be more “binary”; EoEHSS is a more nuanced metric.

Resolve Ph-1b/2a results

First, regarding safety, directly from the press release: “we are observing increasingly positive efficacy signals and excellent safety outcomes, including no adverse events such as candidiasis, adrenal suppression or glucose derangement“.

- One patient achieved complete histological remission, defined by the presence of fewer than six eosinophils per high-powered field on esophageal biopsy.

- Straumann Dysphagia Index (“SDI”), a patient-reported outcome measure designed to assess symptom severity, was lower for all three patients post-administration with peak reductions up to 3 points (50% from baseline). At 12 weeks post-administration, mean SDI reduction was 41% or 2.3 points.

- Eosinophilic Esophagitis Histology Scoring System (“EoEHSS”) scores, which evaluate the severity and extent of EoE, showed the largest percent reduction of any cohort to date at 12 weeks, with peak reduction of 100% in Stage and Grade scores, and a mean 54% reduction in Composite Stage and Grade scores.

- Using data from four biopsy sites, which is consistent with the FDA Guidance for Developing Drugs for the Treatment of EoE, the mean reduction in Peak Eosinophil Counts (“PEC”) was 83% at 12 weeks.

Addressing efficacy, the table below summarizes the mean data from Cohort 5 and presents them in the context of Cohorts 3 & 4 at 12 weeks, for a head-to-head comparison. The dose response and the trajectory are clear, and bode well for future cohorts with more injection sites, a greater coverage of the esophagus, and higher doses per injection.

It is particularly encouraging to see the histology results in the % reduction of eosinophils (PEC) and in the EoEHSS data. Genuine and meaningful efficacy is being observed.

While the cohort sizes are small (3 patients per cohort), there are now 15 patients that have been treated in the trial, 14 of which have achieved a meaningful clinical response. Given that EoE is inflammatory condition, and fluticasone is a powerful anti-inflammatory, the fact that the drug is “working” is not surprising. Fluticasone has been used off-label for years to treat EoE with the FloVent inhaler, but due to poor/ineffective delivery, and side-effects associated with those delivery problems, has only delivered marginal benefit to patients.

An additional read-through from the safety observations is that the release profile (pharmacokinetics, or PK) of the product is working as planned, further confirming the unique delivery characteristics of the DiffuSphere technology.

EPRX- Key Events Since Nasdaq uplisting on April 5, 2024

Despite progress in trials and significant success in the OA trial (Osteoarthritis Knee Pain) and transitioning from Ph-2 to a Ph-3 ready, the stock price has traded within a narrow horizontal channel with low trading volumes, except for sharp spikes on announcement days. This suggests that the company is still under-the-radar of many investors, and when it gains more attention, the price movement could be sharp and rapid.

Currently, the company is focusing on the EoE trial EP-104GI (Eosinophilic Esophagitis) and already reported positive results from Cohort-5 in November after a 12-week follow-up.

On November 12th Eupraxia released data from Cohort-5 of their dose-escalating Ph-2 clinical trial. At this dose level, three patients treated with EP-104GI (48mg fluticasone) showed impressive histological and symptom results, with an 83% average mean reduction in peak eosinophil count (PEC) and a 41% improvement in patient-reported dysphagia scores at week 12. Although the data is from a small sample size and cross-study comparisons can be challenging, EP-104GI’s efficacy already seems to match or exceed that of the two FDA approved drugs, Dupixent (Regeneron & Sanofi) and Eohelia (Takeda). Eupraxia believes that 48mg of fluticasone may still be a suboptimal dose with suboptimal esophageal coverage. With a favorable safety profile so far, Eupraxia plans to continue dose-escalating EP-104GI into additional cohorts.

Source: Eupraxia’s Jan-2025 corporate presentation

It is important to note that this is a dose-escalation trial that will be used to establish the dose and number of injection-sites in the scheduled large Phase 2b trial in 2025.

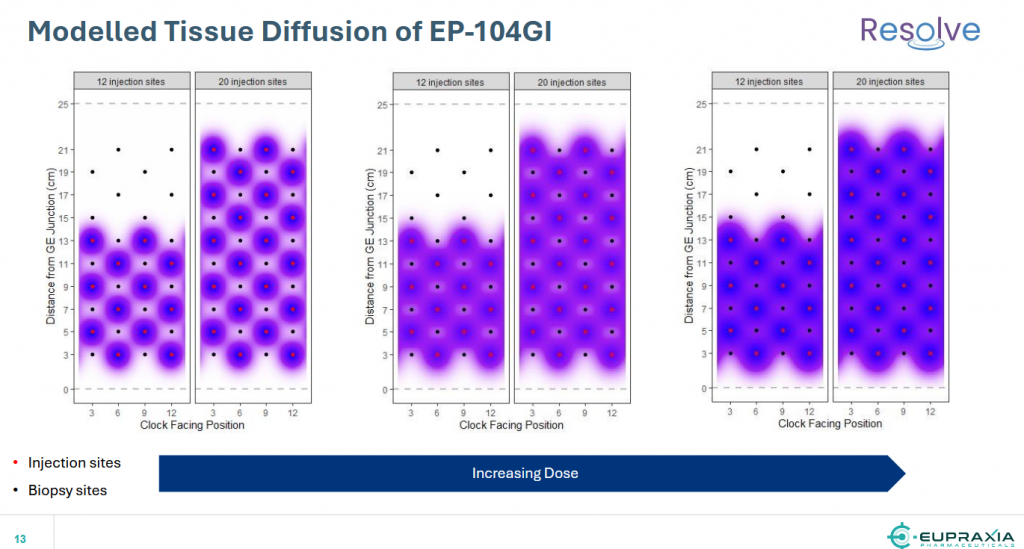

Cohort-5 patients received 12 injections of approximately 4.0mg per injection (total of 48mg), which covered approximately 60% of the esophagus. Cohorts 6, 7 & 8 will increase the dose and number of injections further, to achieve maximum coverage of the esophagus and maximum therapeutic effect.

Source: Eupraxia’s Jan-2025 corporate presentation

Source: Eupraxia’s Jan-2025 corporate presentation

The 12-week follow-up results from Cohort-6 are expected to be released during Q1-2025 (if we count 12 weeks from last report, then most likely in February). However, it is more important to see the results from the 3 patients in Cohort-5 at the 24-week follow-up.

This will help determine if the treatment’s effect lasts long enough to be administered once every 6-months, 9-months, or even a year. Any interval longer than 6-months would be a significant success, especially considering the currently approved drug Dupixent is administered as a weekly injection (painful injection, while only 60% of patients achieve remission, and only 13% full responders and it costs $100K per year per patient).

Another important detail is that patient follow-ups in previous cohorts were up to 24 weeks. Starting with Cohort-6, patients will be followed for 52 weeks, which is crucial for testing the long-term effectiveness of the treatment.

The company aims to determine the optimal dose, which will be the basis for follow-up trials.

According to the company’s presentation, they plan to move to the Phase 2b trial, which will be a placebo-controlled with about 60 patients using the optimal dose, starting in the first half of 2025 (by mid-year).

We will continue to follow the company’s reports and expect to see the next data results released during February!

if the upcoming results from the 24-week follow-up in the EoE trial are positive and show that the treatment is effective with less frequent dosing, it could lead to a substantial increase in stock price. Investors may view this as a significant advancement, improving the drug’s market potential and competitive edge over existing treatments like Dupixent.

EPRX- One-Year Chart and Technical analysis

Year 2024 was a challenging year for the biotech sector marked by the XBI consistently trading side-way, the broader market surged, reflected in indices such as SPY and QQQ repeatedly hitting new 52-week highs. External factors like a high-interest-rate environment posed significant hurdles for microcap biotech firms seeking capital or approaching major pharmaceutical companies for partnership deals. Like many other small cap biotech companies, Eupraxia has been trading into a year-long tight horizontal channel, trending between the levels of US$3.19 to the low of US$2.48. This period is called a consolidation period, where the bulls accumulate at any dip and wait patiently for any signs of breakout.

These days, the price is trading above its 200-Day moving average, and very close to the channel’s upper line and the 50-Day moving average as well, giving investors a chance to add to their position, or a chance for new investors to start building a position at these levels just before the breakout. Any entry at or around US$3 would be a great point as we are heading into several important catalysts starting in February with the Cohort-6 data release, followed by developments in the June-July timeframe.

As we approach the data release, any positive data can push the price higher, finally breaking out of the year-long consolidation. The Bollinger Bands are getting tighter and closer to each other, creating a Volatility Squeeze condition within the bands. This, combined with decreasing volume, confirms the consolidation mode. This sideways movement can potentially last for several weeks or months, usually followed by a volatile move and a breakout of the upper or lower Bollinger Band, creating a fast and long move. The technical price target, based on the depth of the channel (3.19 – 2.48), suggests a move around $0.71 or more. However, it wouldn’t be surprising to see the price breaking the horizontal channel and moving higher towards the US$5 area if the market realizes the huge potential of EoE, which affects over 450K patients in the US alone and has multi-billion-dollar potential.

Valuation and Price Target

Based on recent data, Eupraxia Pharmaceuticals (EPRX) has a market cap of approximately US$110mm or C$154mm.

Cash runway: EPRX has ~US$41M in cash that should be sufficient to fund operations into Q3-2026.

This assumes all costs for the Phase 2 EoE trial and the preparatory work for the Phase 3 OA trial are included. However, funding for the Phase 3 OA trial itself is not factored into the financial runway, as EPRX is seeking a partnership for that stage.

Based on the potential of Eupraxia’s treatment for Eosinophilic Esophagitis (EoE) and the total addressed market, analysts have set a consensus price target of US$9.00 to US$12.00. This represents a forecasted upside of ~190% to 287% from the current price of US$3.10.

The optimistic outlook is driven by the promising clinical trial results for EP-104GI and the potential market size for EoE treatments, which affects over 450,000 patients in the US alone. The total addressed market for EoE treatments is estimated to be in the multi-billion-dollar range.

If the EoE study is successful and the drug gets approved, Eupraxia can capture a significant share of the market due to its superior safety profile and long-acting drug delivery, allowing patients to choose between a once-every-6-months or even once-a-year delivery versus weekly injections. Additionally, the lower cost for payers, with Eupraxia expecting to price their drug at one-third of the approved drug Dupixent, makes it an attractive option for insurers.

We would assign a US$10.00 per share price target to Eupraxia (around C$14.30). We think this upside target is very achievable over the next year if the data readouts on EP-104GI continue to be strong, and the management successfully attracts a partnership deal for the OA program EP-104IAR, not to mention the potential of a new indications using Eupraxia’s proprietary Diffusphere™ delivery technology.

Risk consideration

Like any other biotech venture, there is risk associated with clinical trials, and Eupraxia shares a similar risk profile. If the Resolve study fails, the share price will be under extreme pressure, and Eupraxia will rely on the next trial in OA to recover. Therefore, exercising caution and conducting thorough due diligence are imperative when considering investments of this nature.

Disclosure: The author is long EPRX in the US & Canada markets.