Bristol-Myers Squibb Company (BMY) –NYSE

Bristol-Myers Squibb Co. (BMY) had a wild year, up from the lows of $41.11 in late August 2013 to reach a new 12 years high $57.49 in early March 2014, as investors were anticipating the anti PD-1 data coming at ASCO-2014 and with high expectations for BMY’s data of the Yervoy/nivo combination in lung cancer. But the share price started dropping along with the biotech sector as the IBB was trending down sharply. Moreover, BMY dropped hard the day when the ASCO’s abstracts were published online. Clearly investors had lowered their expectations for the Yervoy/nivo combination. The best response rate was 25% and with dramatically higher toxicity. The stock dropped down over 6% on underwhelming results of Yervoy/nivolumab combo in lung cancer study, opening a gap down from the previous day close at $52. 12 reaching the low of $48.10 but closed at $48.93.

Daily Chart

During the downtrend the price action started forming a well know pattern, called “The Falling Wedge” that is a generally bullish pattern, signaling that we will likely see the price break upwards through the wedge and move into an uptrend. the upper trendline using as a resistance line, have a sharper slope than the support level in the wedge construction (Brown lines). When the lower trendline that used to be a support line is clearly flatter as the pattern forms, it signals that selling pressure is waning, as sellers have trouble pushing the price down further each time the stock is under pressure.

What’s Next

On June 25th we had a fake breakout of the falling wedge’s upper resistance line, along with the weekly horizontal line $49.14, but failing to close above the line and a technical correction for the last short term uptrend just started, reaching the support line around $47.52 and bouncing back. Traders are watching the second try of the breakout that should come on increasing volume to confirm the breakout and close above the line as well. Next hurdle is the 50-Day moving average around the $49.00 and the weekly line at $49.14.

On July 24th, 2014 BMY will report the second quarter results, but investors are looking for more updates on nivo, especially after the halting of nivo’s phase III trial in front line metastatic melanoma, where the sentiment started turning around and getting positive, as BMY have a series of nivo trials about to report in the next 6-12 months and they should provide nice upside including the CheckMate-063 data, a single-arm Opdivo monotherapy in 3rd line squamous lung cancer and to be followed by CheckMate-017 and 057 Interim data phase-3 2nd line Lung Cancer, moreover, the hematology program at ASH-2014 in December this year.

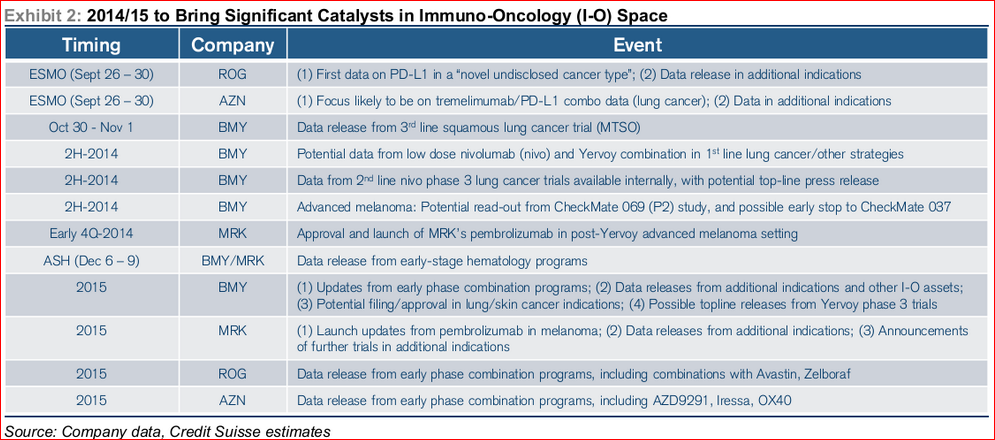

Coming Catalysts in Immuno-Oncology 2014-2015

Disclosure: Author is long BMY Dec & Jan’15 calls